Understanding the Need for Immediate Financial Assistance

In times of financial distress, the need for immediate assistance becomes a pressing reality for many individuals and households. Whether faced with unexpected medical expenses, car repairs, or other unforeseen emergencies, the urgency of obtaining financial aid cannot be overstated. Without access to immediate funds, the consequences can be far-reaching, potentially affecting one’s everyday life, well-being, and even long-term financial stability.

Exploring Options for Quick and Easy Cash Solutions

When faced with unexpected expenses or financial emergencies, it is crucial to explore options for quick and easy cash solutions. Fortunately, there are several avenues available to individuals in need of immediate financial assistance. One such option is to consider borrowing from friends or family members who may be willing to lend a helping hand during difficult times. While this can be a convenient solution, it is important to approach these arrangements with professionalism and a clear understanding of the terms and expectations involved.

Another potential option for obtaining quick cash is through pawn shops or resale stores. These establishments allow individuals to exchange valuable items, such as jewelry or electronics, for immediate cash. However, it is essential to carefully evaluate the terms and conditions of these transactions, as the amount of money received may be significantly less than the item’s actual worth. Additionally, it is crucial to consider the sentimental value of the item being pawned and whether it is worth parting with for the sake of short-term financial relief.

Evaluating the Benefits of Short-Term Borrowing

When faced with a sudden financial need, short-term borrowing can provide a range of benefits that make it an attractive solution. One significant advantage is the speed with which these loans can be obtained. Unlike traditional loans, which often require extensive paperwork and a lengthy approval process, short-term borrowing can provide quick access to funds, sometimes within a matter of hours. This can be especially crucial in emergency situations where immediate financial assistance is needed.

Another benefit of short-term borrowing is the flexibility it offers in terms of repayment options. With traditional long-term loans, borrowers are usually locked into a fixed repayment schedule that can extend for several years. In contrast, short-term borrowing typically involves smaller loan amounts that are repaid over a shorter period, typically within a few months. This allows borrowers to quickly address their financial needs without being burdened by long-term debt obligations. Additionally, the shorter repayment period allows borrowers to quickly build a positive credit history if they consistently make timely payments, which can be beneficial for future borrowing endeavors.

Navigating the Application Process for Short-Term Loans

The application process for short-term loans is typically fast and straightforward. To begin, you will need to gather all necessary documents and information that the lender may require. This may include proof of income, identification documents, and bank statements. It is crucial to ensure that all the details provided are accurate and up to date to prevent any delays in the approval process.

Once you have gathered all the necessary paperwork, you can start filling out the application form. This form will typically ask for personal information, such as your name, address, contact details, and social security number. You may also need to provide information regarding your employment, including your employer’s name and contact information. Be sure to double-check all the information before submitting the application to eliminate any errors or discrepancies that could affect its processing.

After submitting the application, the lender will review your information and assess your eligibility for a short-term loan. This process usually takes a short amount of time, and you may receive a decision within a few hours or even minutes, depending on the lender’s policies. If your application is approved, the lender will provide you with the loan terms, including the interest rate, repayment period, and any additional fees. It is important to carefully review all these terms before accepting the loan to ensure you understand your obligations and can meet the repayment requirements.

Considering the Risks and Responsibilities of Borrowing

When considering the risks and responsibilities of borrowing, it is important to thoroughly understand the implications of taking on debt. While borrowing can provide immediate financial relief, it also comes with certain obligations that should not be taken lightly. One of the main risks of borrowing is the potential for accumulating high interest charges, which can significantly increase the overall cost of the loan. It is crucial to carefully review the terms and conditions before committing to any borrowing agreement to ensure that you are aware of the interest rates and any additional fees that may apply.

Responsibility is another key aspect of borrowing. Taking on a loan means committing to repay the borrowed amount within a specified timeframe. This responsibility extends beyond simply making the monthly payments on time. It also entails managing your finances effectively to ensure that you can meet your financial obligations without sacrificing your other essential expenses. Failure to meet the repayment terms can result in consequences such as late payment fees, a negative impact on your credit score, and potential legal actions by the lender. Therefore, it is vital to assess your ability to repay the borrowed amount before taking on any financial obligations.

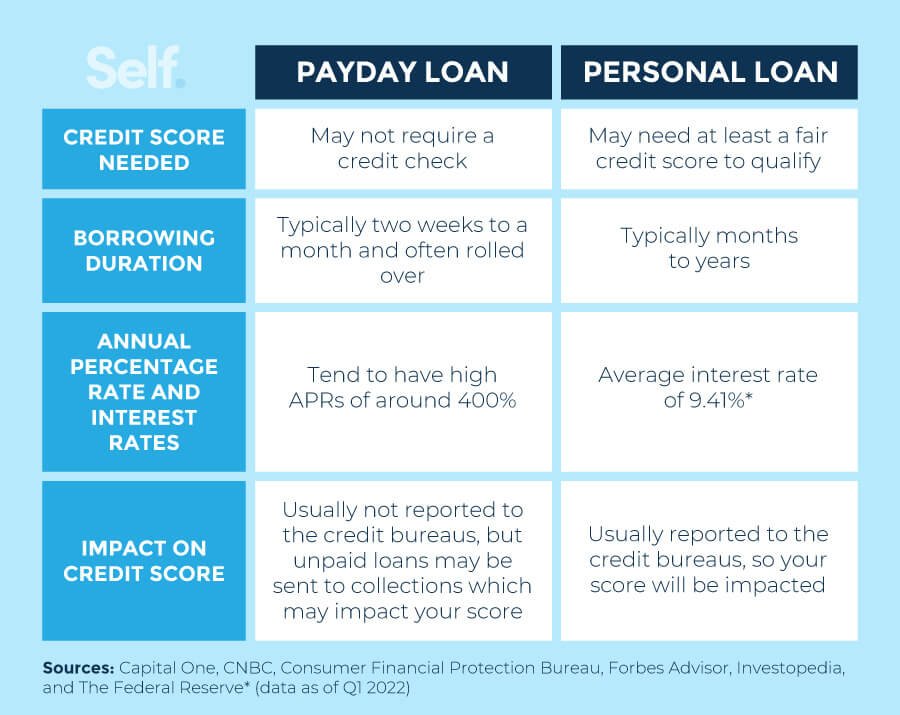

Examining the Role of Credit Scores in the Loan Approval Process

When it comes to getting a loan, one factor that plays a crucial role in the approval process is your credit score. Lenders consider credit scores as an important indicator of an individual’s financial health and ability to repay the loan. Essentially, your credit score is a numerical representation of your creditworthiness based on your credit history. It reflects your past borrowing and repayment behaviors, including any missed payments, defaults, or existing debts.

A higher credit score generally signifies responsible borrowing habits and reliable financial management. Lenders typically view individuals with higher credit scores as less risky borrowers, which increases their chances of loan approval. On the other hand, a lower credit score may pose challenges in obtaining a loan, as it suggests a higher risk of default or late payments. Lenders may either deny the loan application or offer less favorable terms, such as higher interest rates or stricter repayment conditions. Therefore, it is essential to have a clear understanding of your credit score and its potential impact on your loan application.