Income Verification

Income verification is a crucial step in various financial processes, such as applying for loans, renting a property, or even applying for certain jobs. This process involves providing proof of one’s income to ensure that they have the financial means to meet their obligations. Typically, income verification requires the submission of recent pay stubs, employment contracts, or bank statements that clearly indicate the individual’s earnings.

In addition to these documents, some institutions may also require individuals to provide their tax returns as part of the income verification process. Tax returns offer a more comprehensive view of an individual’s financial situation, showcasing their income over a longer period of time. This additional information can help lenders or landlords assess the stability of an individual’s income and make informed decisions about their eligibility for loans or tenancy agreements. By carefully examining income verification documents, financial institutions can mitigate the risk of lending money or entering into agreements with individuals who may not have the means to fulfill their financial commitments.

Employment History

Including an employment history section in a verification process serves as a crucial step in evaluating an individual’s eligibility for certain opportunities or benefits. This section typically involves obtaining detailed information about the candidate’s previous employment engagements to garner insights into their professional background and work experience. Employers, lenders, or institutions conducting the verification generally seek to verify the durations of the candidate’s employment, the positions held, as well as any notable achievements or contributions made during their tenure.

Moreover, it is crucial to note that a comprehensive employment history section also helps in assessing an individual’s reliability and stability. By reviewing the candidate’s employment history, organizations can gain valuable insights into their ability to maintain long-term commitments and dedication towards their respective roles. Additionally, this section allows employers to identify any gaps in employment, enabling them to query the candidate further regarding any reasons or circumstances leading to such breaks. The employment history section essentially acts as a valuable tool in assessing a candidate’s professional capabilities and potential suitability for the desired opportunity or financial assistance.

Credit Report

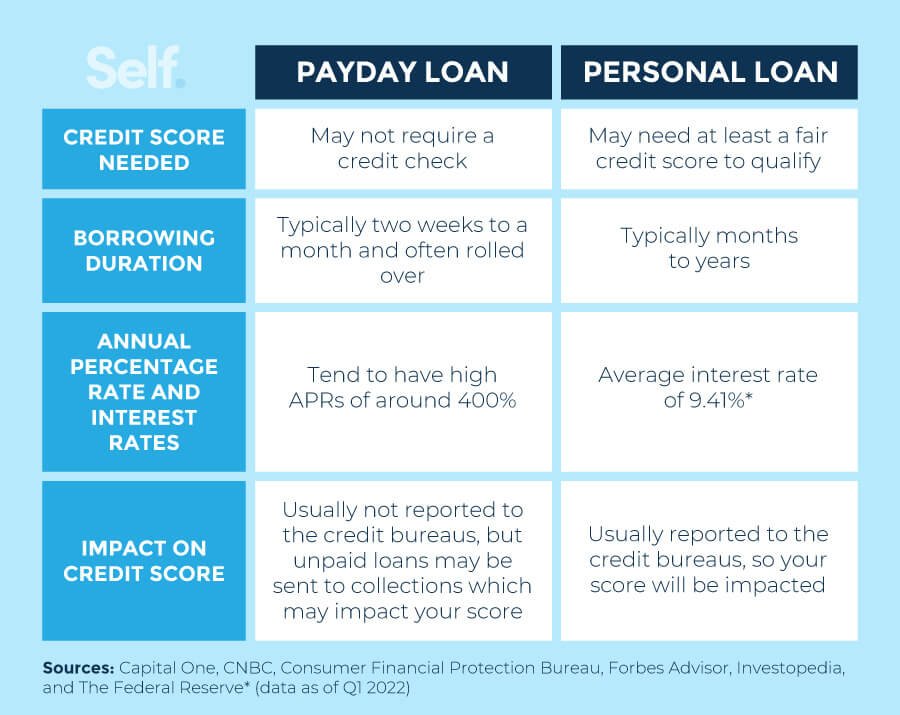

A credit report is a crucial document that lenders and financial institutions use to assess an individual’s creditworthiness and financial stability. It provides a comprehensive overview of an individual’s borrowing and repayment history, including information about credit cards, loans, and other credit accounts. Lenders use this information to determine whether an individual has a good track record of managing credit and whether they are likely to repay future debts in a timely manner.

In addition to providing details about an individual’s current and past credit accounts, a credit report also includes information about any late payments, defaults, bankruptcies, or other negative events that may have occurred. By reviewing this information, lenders can better understand an individual’s financial behavior and assess the level of risk associated with extending credit to them. It is essential for individuals to regularly review their credit reports to ensure all information is accurate and to take steps to address any discrepancies or errors that may negatively impact their creditworthiness.

Bank Statements

Bank statements are an essential part of the documentation required when applying for various financial services. These statements provide a detailed record of an individual’s financial transactions and can offer valuable insights into their spending habits, income, and overall financial stability. Lenders, landlords, and other financial institutions often request bank statements to verify an individual’s income, ensure timely payment of bills, or assess their eligibility for loans or rental agreements.

When reviewing bank statements, financial institutions pay close attention to several key factors. Firstly, they examine the consistency and regularity of income deposits to determine whether the applicant has a stable source of income. Additionally, they analyze the applicant’s spending patterns to evaluate their financial responsibility and ability to manage their finances effectively. Negative indicators such as overdraft fees or bounced checks may raise concerns during the evaluation process. By closely scrutinizing bank statements, financial institutions aim to assess an individual’s financial health and their capacity to meet their financial obligations.

Tax Returns

When it comes to applying for a loan or a mortgage, tax returns play a crucial role in the verification process. Lenders often request copies of your tax returns to verify your income, assess your financial stability, and determine your ability to handle monthly loan payments. Through your tax returns, lenders can thoroughly examine your financial history, including your income sources, deductions, and any outstanding tax liabilities. They use this information to assess your financial health and determine the amount of risk involved in lending to you. Therefore, it is essential to ensure that your tax returns are accurate, up-to-date, and prepared diligently by a qualified tax professional.

One significant aspect that lenders focus on in tax returns is your gross income. By analyzing your tax returns, lenders can determine your average income over the past few years. This information is crucial for determining your ability to afford loan repayments and manage your debt-to-income ratio. Lenders typically prefer stable and consistent income patterns, and any fluctuations or inconsistencies in your income shown in your tax returns may raise concerns for them. To enhance your chances of loan approval, it is advisable to maintain consistent and documented income records throughout the years, which can help you present a strong case to lenders based on your tax returns.

Identification Documents

When it comes to the loan application process, one crucial aspect that lenders review is the submission of identification documents. These documents serve as proof of your identity and help ensure the security of the transaction. Typically, applicants are required to provide a valid government-issued ID, such as a driver’s license or passport, as well as any additional documents requested by the lender. It’s important to submit clear and legible copies of these documents to avoid any delays in the application process.

Lenders request identification documents to verify your identity and ensure that you are who you claim to be. This is a standard procedure that helps combat fraud and protect both the lender and the borrower. Providing accurate and up-to-date identification documents not only shows your commitment to the loan application process but also helps establish trust between you and the lender. Keep in mind that lenders may have different requirements regarding the types of identification documents they accept, so it’s essential to review their guidelines carefully and submit the correct documents accordingly.